Grab in Southeast Asia

Grab is a multi-service platform providing transportation, food delivery, digital payments, and other essential services across Southeast Asia (Singapore, Malaysia, Thailand, Philippines, Indonesia, Cambodia, Vietnam)

Under Grab Financial Group‘s umbrella, PaySuite is Grab’s very own in-house acquirer/payment gateway with direct connections to card Networks.

As a Senior Product Manager, I had the opportunity to collaborate with numerous cross-functional departments, including operations, finance, legal, business development, marketing, risk, and compliance.

Additionally, I worked closely with payment partners to enhance our connections with them in the region.

Product Vision

1. Optimize payment transactions within Grab by reducing costs.

2. Simplifying online payment acceptance for both internal teams and SMEs.

Projects and Responsibilities

Grab x PaySuite Acquiring Stack

Opportunity

- As the Grab app has millions of transactions a day, there is a potential cost savings by building an in-house payment processing platform.

- Having a foothold in the market as a acquirer can also allow Grab to process payments for other merchants and partners.

Implementation

- Co-Led the establishment of Grab’s acquiring stack from inception, overseeing key components such as direct connections to payment schemes, robust finance reporting systems, reconciliation processes, transaction management portals, and initiatives to enhance operational efficiency.

- Launched the payment gateway API for external partners to integrate to the Grab’s Payment Gateway.

- Oversaw as main point of contact in implementation for initial integrating partners.

Results and Success Metrics

- Great total cost savings (undisclosed).

- Integration to payment facilitator partners brought in revenue (undisclosed).

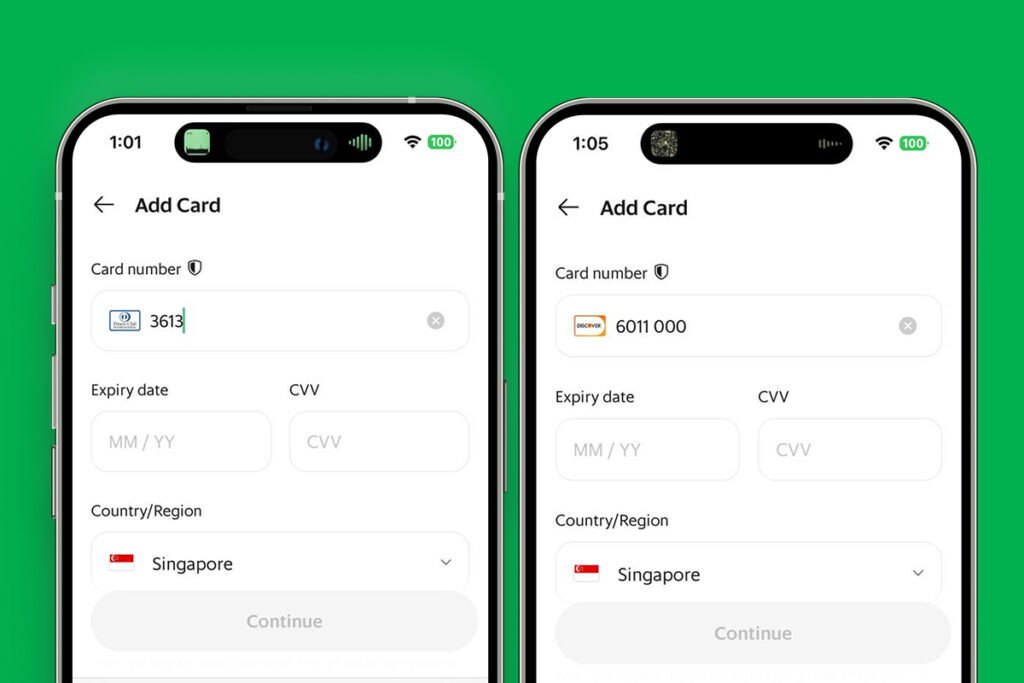

Diners and Discover card (now DCS) acceptance in the Grab Ecosystem

Opportunity

- To increase card offerings made available on the Grab app.

- Allow travelers in the SEA region to use their current cards from Diners and Discover, reducing onboarding friction.

Implementation

- Launched card acceptance in applicable countries on all verticals (e.g. Food, Transport, Express, etc).

- Changes implemented on both web and app platforms.

Results and Success Metrics

- Uptick on add card rate at X% (Undisclosed).

- Uptick for cards added by travelers at X% (Undisclosed).

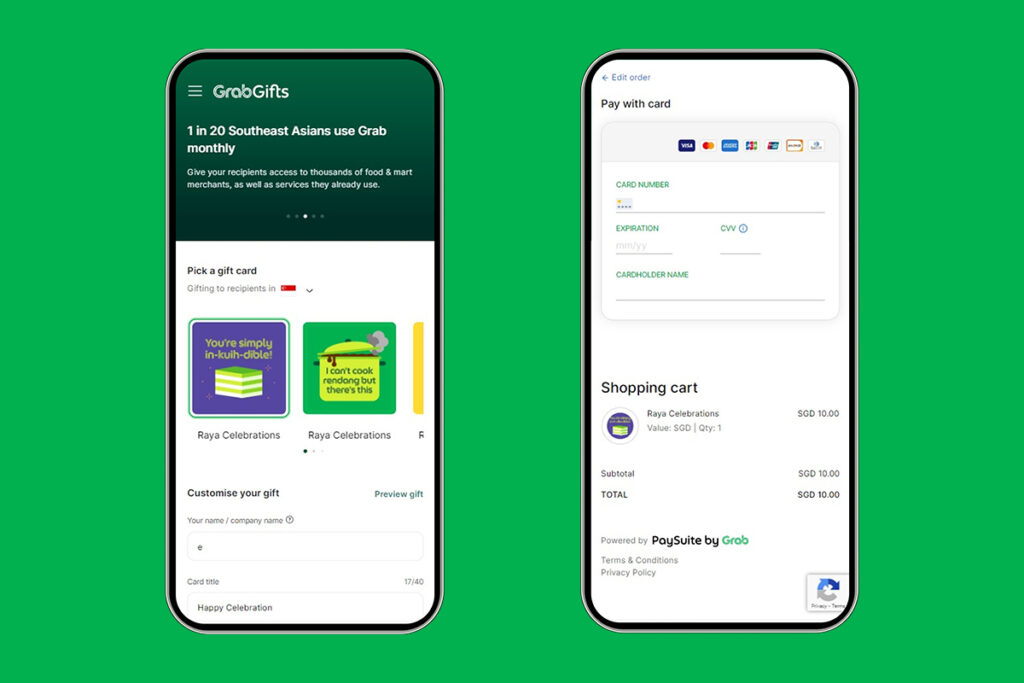

GrabGifts Web Payment Funnel Enhancements

Opportunity

- GrabGifts was using 3rd party payment partners to transact bulk purchasing on vouchers on the web app.

- Bringing it for in-house processing will bring cost savings from 3rd party payment platform costs.

Implementation

- Launched the Hosted Payment Page (HPP) solution for PaySuite.

- Migration of payment page after voucher selection to PaySuite’s HPP solution.

Results and Success Metrics

- Easier tracking and reporting from end to end as experience is full on the Grab platform.

- Cost savings of $X (undisclosed) a year from 3rd party payment platform costs.

GrabPay acceptance on Shopbuilders

Led initiatives to develop widgets on WooCommerce and Shopify to accept GrabPay acceptance.

Pay by Link

Developed the “Pay by Link” feature, facilitating fund collection for undisclosed Grab departments, enhancing payment flexibility and convenience.

Funds Flow and Reconciliation Engine

Engineered a robust reconciliation system for the operations and finance teams, optimizing funds flow processes and enhancing operational efficiency by 70%.

Visa Tokenization Service

Launched Visa tokenization service in Vietnam and Malaysia for Grab, enhancing payment security for Grab users in these markets.

Routing Engine Enhancements

Guided and spearheaded design optimization on the routing interface to provide a better user experience and interface. Routing tasks efficiency increase by 50%.

Vendor Management

Project managed with multiple external 3rd party technical partners for certain features of our internal stack.